I’ll be very honest! Investing in the stock market is subject to market uncertainties. Not as risky as cryptocurrency, but also not as safe as fixed deposits.

In today’s world, not taking any risk is the biggest risk! There are different types of risks involved everywhere. Life is about managing risk, not avoiding it. If our ancestors always played it safe and never sacrificed in their comfort zones, we wouldn’t have the standard of living we have today.

In any case, if you are aware of the risks associated with them, you may be able to manage them or devise a backup plan for them.

Systematic and unsystematic risks

Systematic and unsystematic risks are the two major types of risks. Given that the cycle involves your hard-earned money, there are a variety of risks associated with an investment in the stock market. Some are avoidable, while others are unavoidable, so you have to be prepared to deal with them if they arise.

Let us first understand unsystematic risk:

Unsystematic risks

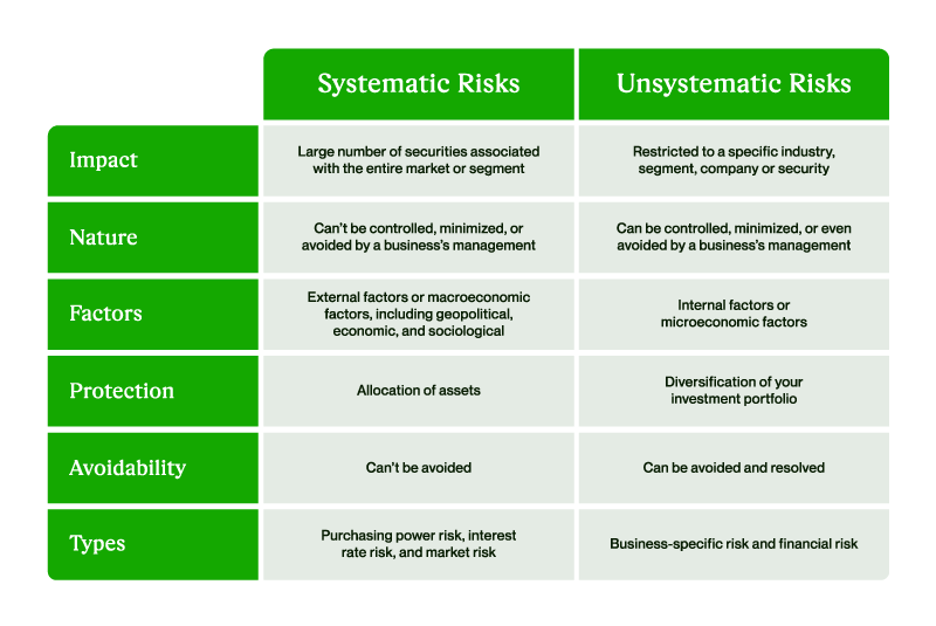

Unsystematic risks, also known as “nonsystematic risks,” “specific risks,” and “diversifiable risks,” are specific to one company or industry. They arise due to factors within a particular company, but those factors can vary from industry to industry.

Unsystematic risks can be managed, reduced, or even completely avoided. They could be factory worker disputes, regulatory modifications like a new law mandating the removal of toxic waste by the following year, a lack of raw materials, etc.

Unsystematic risks include:

– Business Risks

Business risk, also known as operational risk, mostly arises when a company or enterprise organization is unable to make enough sales of goods or provide enough services to cover its cost of operations. As a result, this risk is closely linked to how the company is running.

– Financial Risks

This kind of risk can develop if a corporation is unable to meet its predefined financial goal. This mainly affects leveraged businesses that rely on debt financing for their operations. Financial risk occasionally has the potential to sink an organization.

Systematic risks:

Systematic risks are in complete contrast to unsystematic risks; they are unavoidable threats in the stock market. Since they affect the entire industry, they are also renowned as “non-diversifiable risks.”

Non-diversifiable shows that the company is not able to manage, minimize, or prevent systemic risk. Such risks are frequently brought on by a wide range of macroeconomic aspects, like the current geopolitical environment, economic policy, environmental catastrophes, etc.

To understand this unavoidable risk more deeply, here are the major types of risks involved in systematic risk.

– Inflation Risks

Inflation risks refer to a depreciation in the purchasing power of the currency. As a result, the buying power of the consumer decreases, which affects the sales of organizations. Additionally, the cost of raw materials also increases due to a rise in inflation, which affects production costs.

For more understanding read: Important Impact of Inflation on Stock Market – Stockoholic

– Market Risks

Market risks are referred to as “daily price changes” in the market. It’s the ultimate result of investors’ typical preference to follow the market. The market indices Sensex and Nifty fluctuate throughout the day. It may also frequently have an impact on a stock’s performance.

For instance, if the market is falling at a certain moment, even high-quality equities may see their values fall. Market risk typically makes up around two-thirds of all systematic risk.

– Interest Risks

Interest rates on the domestic market and the global market fluctuate periodically. And based on the direction in which the rate of interest is trending, this may have a favorable or unfavorable impact on the stock market.

For instance, a business may have trouble borrowing money when interest rates are too high (at high rates). Additionally, if interest rates rise, the securities market will shrink, which might potentially have an impact on organizational bonds.

Wrapping Up

There are several threats associated with stock market investment. However, you may manage the risk if you get the fundamental idea driving the uncertainty associated with equities.

In the stock market, risk-takers are rewarded with profitable and high returns for taking “smart and calculated risks.”

That’s all there is to it. I hope you find this post helpful. Please let us know in the comments below how you are going to manage the risks involved.